1 Helpful steps

| Helpful Steps | Description |

|---|---|

| Immediate Steps |

|

| Executor & Funeral Planning |

|

| Important Documentation |

|

| Beneficiaries and Estate Value |

|

| Other tasks |

|

| Super and Insurance |

|

| Grant of Probate |

|

| Finalise and distribute estate |

|

2 Estate Planning Basics

Intestate

When you pass away without a Will, state law determines who receives your assets

Will

A legal document that states who you want to receive your assets when you pass away

Trust

Trusts including superannuation are generally excluded from your estate

Power of Attorney

Gives another person the authority to handle your financial affairs during your incapacity

Healthcare Power of Attorney

Give another person the authority to make medical decisions for you during your incapacity

Excluded Assets

Superannuation * Joint ownership of property real and personal Trust Asset where you may be the beneficiary * unless specified in a binding nomination or by the trustee to be subject to the estate

Probate

The process by which the court determines the validity of your will

Estate Tax Returns

This applies in some instances

Letters of Administration

Applies in all cases of intestacy

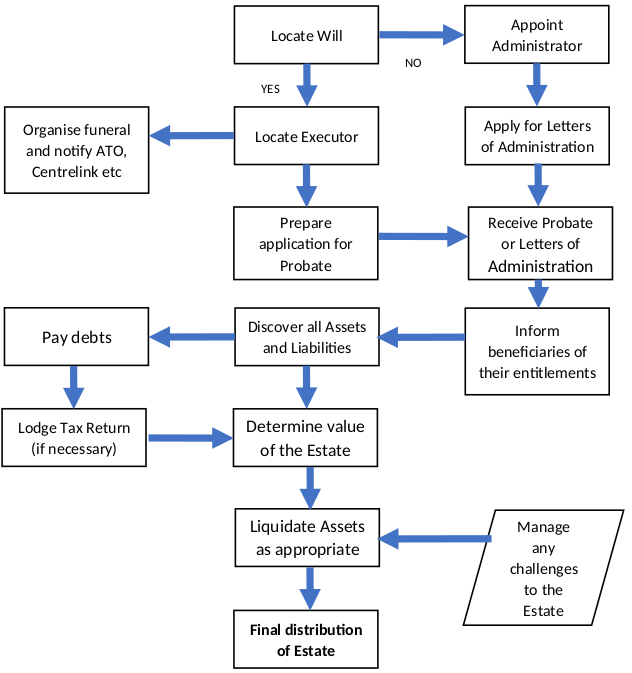

3 Flowchart of Deceased Estates